Insurance Education in India

insurance institute of india, mumbai

Formerly known as Federation of Insurance Institutes (J.C. Setalvad Memorial) (Regd.)

Established: 1955

Head Office: Mumbai

Objective: for the purpose of promoting Insurance Education & Training in the country

Mode of Examination: Online, through various centres in India and Abroad

Courses:

This Institute is well known for its Licentiate(LIII), Associateship(AIII) and Fellowship(FIII) certifications in both General and Life Insurance Branches. For achieving Fellowship, a candidate have to clear Licentitate and then Associateship in respective insurance branch.

Licentiate Examination- This is the introductory level of Certification. In this there is only 02 Compulsory subjects along with 01 elective from chosen Life or General insurance branch.

Associateship Examination- This is the Second level of Certification. In this candidate have to select specifically Life or General Insurance Branch. After Selection candidate have to pass all subject courses from the selected branch. In this the candidate will become more familiar with different types of Insurance and it’s related coverages, Clauses and policy wordings of selected branch.

Fellowship Examination- This is the highest level of Certification. In this the candidate have to be master with advanced studies of selected branch of Insurance.

Presently subject wise Credit point system is followed for clearing above all 03 certifications. A candidate have to earn minimum credit from clearing Compulsory and Elective subjects. The creditwise criteria for clearing exams are as below:-

Licentiate Certificate – 60 credit points

Associateship Diploma – 250 credit points(including the credit points at Licentiate level)

Fellowship Diploma – 490 credit points ( including the credit points at Licentiate and Associateship levels)

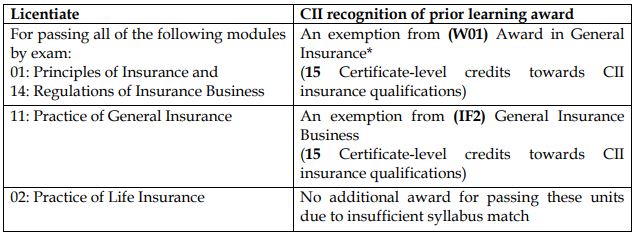

The Chartered Insurance Institute(CII), London also give recognition of subjects covered under above Certifications of Insurance Institute of India(III)- details are given below in table.

Recognition of III Courses by CII

Arrangement Scheme between Chartered insurance Institute(CII), London and Insurance Institute of India(III), Mumbai

Apart from this Insurance Institute of India(III) also conducts and award below Certificate and Diploma courses:-

1. Certificate in Foundations of Casualty Actuarial Science (General Insurance)

2. Certificate in Insurance Salesmanship.

3. Specialized Diploma on Marine Insurance

4. Specialized Diploma on Fire Insurance

5. Specialized Diploma on Health Insurance

6. Certificate Programme in Advanced Insurance Marketing (CPAIM)

7. Certificate Course in Foundations of Casualty Actuarial Science

8. Specialized Diploma in Casualty Actuarial Science

9. Diploma in Life Insurance Underwriting

10. Advance Diploma in Life Insurance Underwriting

11. Compliance, Governance and Risk Management in Insurance

JOINTLY OFFERED COURSES

Apart from It’s regular courses, Insurance Institute of India(III) also offers Diploma and Certification courses jointly with below Educational Institutions :

A. Association of Insurance Underwriters (AIU), Mumbai

B. The Institute of Company Secretaries of India (ICSI), Delhi

C. University of Mumbai, Mumbai

Below are the details of these courses:-

A. Association of Insurance underwriters (AIU), Mumbai- Insurance Institute of India (III) also offered 02 jointly courses with Association of Insurance Underwriters (AIU), Mumbai, viz.

Level-1 (Basic Level) Diploma in Life Underwriting (DLU)–It consists of Five Papers, which are a combination of mandatory 3 Insurance Institute of India Papers (IC-01, IC-02, IC-22) which introduce the candidate Basic Concepts of Insurance and Underwriting.

Level 2 (Advanced Level) Advanced Diploma in Life Underwriting (ADLU)- It consists of Three Papers, which covers Intermediate Medical & Non-Medical Life Insurance Underwriting & Advanced Life Insurance Underwriting.

B. The Institute of Company Secretaries of India (ICSI), Delhi- Insurance Institute of India(III) and The Institute of Company Secretaries of India (ICSI) jointly offers Certificate Course on Compliance, Governance and Risk Management in Insurance.

This course is divided in 2 parts i.e.

1) Online Examination

2) Class room training of 3 days

This course deals with Fundamentals of Insurance, Insurance Regulations, Governance and Compliance and Risk Management in Insurance.

C. University of Mumbai- In collaboration of University of Mumbai, Insurance Institute of India also offers 02 Post Graduate Diploma Courses. Details are as below:-

Post Graduate Diploma in Health Insurance(PGDHI)

Duration- 01 Year

Eligibility- Graduation- Both Fresher & working Professional can join

Mode- Weekend Classroom Sessions

Research Projects

Diploma jointly awarded by Insurance Institute of India and Mumbai School of Economics and Public Policy(Autonomous)

Post Graduate Diploma in Insurance Marketing(PGDIM)

Duration-01 Year

Eligibility- Graduation- Both Fresher & working Professional can join

Mode-Weekend Classroom Sessions

Research Projects

Diploma jointly awarded by Insurance Institute of India and Mumbai School of Economics and Public Policy(Autonomous)

Insurance Institute of India (III) also conducts exams training for below Insurance intermediaries. :-

a. Insurance Agents

b. Corporate Agents

c. Insurance Marketing Firm

d. Web Aggregators

e. Brokers Examination Training-Licensing and Renewal

f. Individual,Composite and Reinsurance Broker

Broker Examination’s for fresh Licensing and Renewal of Licensing is conducted by National Insurance Academy, Pune.

Insurance Institute of India (III) is a Research Centre for Ph.D. Degree in Business Management (Commerce) recognized by the University of Mumbai.