Insurance Education Globally

Prestigious institutes offer Globally recognized Certificates and Diplomas

insurance education globally

Insurance Education Globally Is well Known By its repute one “Designations”.

These Designations Are Awarded By The Global Repute Institutes By Passing Or Clearing Their Certificate, Diploma,Fellow Or Chartered Courses.

The Study Pattern Of All Institutes Are ONLINE And Self Paced Study, So That Any Body Who Is Interested Can Be Enrolled And Can Earn These Designations.well

American Institute For Chartered Property Casualty Underwriters (AICPCU)

American Institute for Chartered Property Casualty Underwriters (AICPCU) — an independent nonprofit organization providing educational programs and professional certification to people engaged in the property-casualty (P&C) insurance industry.

It is popularly known as “The Institutes” by Industry professionals.

What is a Designation-The Institute’s Designation are most reputable Insurance credentials, which can be earned by professionals by passing that course.

It’s having two subsidiary organization as

“The Institutes” is having its repute in the Field of Insurance and Risk Management Globally.The professionals from this Institutes earns most respect and positions across Insurance and Risk Management sector.

The Institute having three way study pattern as per requirement of Insurance professionals.

The learning pattern of these designations are online and Self Study.

For more information on these courses,check website of "The Institute"

- Designation Course

- Certificate Course

- Topic Course

- Micro-Certs

Institutes designations are the most reputable risk management and insurance credentials that help professionals make better business decisions.

These designations provide competitive edge to all Insurance professionals for all like Agents,Brokers,Insurers,Independent Adjusters or Third Party Administrators

The Institute is having more than 25 designations covering all Insurance sectors, which helps people improve their skills, enhance their credibility and take the the next step in the career.

The most popular designations are CPCU,ARM, AINS, AIC, AIDA, and AU

At present below Designations are offer by the Institute. The Institutes also kept on adding new Designations as per the advancement of the Insurance and Risk Management sector.

-Associate in Claims(AIC) -Associate in Commercial Underwriting(AICU)

-Associate in General Insurance -Associate in Insurance Data Analytics (AIDA)

-Associate in Risk Management(ARM) -Chartered Property Casualty Underwriter (CPCU)

-Accredited Adviser in Insurance -Accredited Adviser in Insurance-Management

-Accredited Customer Service Representative-Commercial Lines -Accredited Customer Service Representative-Life and Health

-Accredited Customer Service Representative-Personal Lines -Associate in Claims-Management

-Associate in Commercial Underwriting-Management -Associate in Fidelity and Surety Bonding

-Associate in Information Technology -Associate in Insurance Accounting and Finance

-Associate in Insurance Services -Associate in Management

-Associate in Marine Insurance Management -Associate in National Flood Insurance

-Associate in Personal Insurance -Associate in Premium Auditing

-Associate in Regulation and Compliance -Associate in Reinsurance

-Associate in Surplus Lines Insurance -California Workers' Compensation Claims Professional

-Professional Risk Consultant -Senior Professional Public Adjuster

The Institute offers 03 specialize courses under its Certificate programme:-

-California Workers’ Compensation Claims Administration (WCCA™) -Property Technical certificate (PTC)

Supervisory Management (SM)

Topic Courses are Short Online courses and can be completed within a few hours.

These courses are designed to provide knowledge on emerging trends and Insurance fundamentals

The Institute offers below specialized courses under its Topic Courses:-

-Blockchain in Insurance -Introduction to Risk Management and Insurance

-Applying Cyber Risk Management Strategies -Captive Insurance Fundamentals

-Cyber Risk Fundamentals -Discovering the Basics of Insurance

-Emerging Technologies and Risk -Ethical Decision Making in Risk and Insurance

-Ethical Guidelines for CPCUs -Executing ERM in Your Organization

-Insurance Essentials -International Insurance Fundamentals

-Mastering Holistic Risk Management -Successful Starts for CSRs

-Successful Starts for Producers

If you are not sure about enrolment any detail study program, then should try Micro-Certs.

It helps to sharpen your skills and advance your knowledge as you explore key facets of the risk insurance industry and develop your career path and focus.

Some of the below Micro-Certs programs running are

- Closing Commercial Coverage Gaps

- Helping Clients Prepare for the Worst

- Understanding Supplemental Personal Lines

- Managing Clients' Cyber Risks

- Leading and Coaching Skills

- Identifying Commercial Clients' Risks

Check more details on the institute website

life office management association (LOMA)

- Designation Programmes

ACS® Associate, Customer Service™

AIRC™ Associate, Insurance Regulatory Compliance®

ALMI® Associate, Life Management Institute™

ARA™ Associate, Reinsurance Administration™

ASRI™ Associate, Secure Retirement Institute™

FLMI® Fellow, Life Management Institute™

FSRI™ Fellow, Secure Retirement Institute™

LCIC™ LOMA Certified Insurance Consultant™ (Spanish)

- Certificate Programmes

FLMI Level I: Insurance Fundamentals

FSRI Level I: Certificate in Retirement Essentials

Certificate, Customer Experience Essentials

Regulatory Compliance Essentials

Certificate in Underwriting

- Courses

There are number of Short term courses provided by LOMA.

These can be divided into two segments, viz.

- Short Online Courses

- Underwriting Courses

Some of major one are:-

ACS 101 — Customer Service for Insurance Professionals

AIRC 411 — The Regulatory Environment for Life Insurance

ARA 440 — Reinsurance Administration

LOMA 320 — Insurance Marketing

- Trainings

Under this there are mainly three type of training support:-

- Insurance Immersion

- Onboarding Trainings

- Learning Live Series

For more information on above courses,check website of "LOMA"

The Institute for Global Insurance Education(IGIE) offers membership to premier Institutes of different countries.

After become member of IGIE, the students of respective institutes can get enroll in below 02 Life and Non Life courses:-

- IGIE 951 Life Course Outline, Life Insurance Basics

- IGIE 950 – US – Non-Life – Online Course and Exam,Introduction to Global Risk Management, Insurance, and Financial Services

At present below institute of different countries are members of IGIE:-

- Bahrain Institute of Banking & Finance (BIBF)

- Bermuda Insurance Institute

- CPCU Society

- Foundation for Insurance and Finance Education (FIFE)

- Fundacao Getulio Vargas (FGV)

- Insurance Institute of India

- Insurance Institute of South Africa

- Insurance Institute of Switzerland (IIS)

(The Insurance Institute of Switzerland will be closed. All activities will continue at the ZHAW, School of Management and Law, at the Institute of Risk & Insurance.)

- Interfima

- National Insurance Academy, Pune, India

- Royal Center for Legal Training & Studies

- Taiwan Insurance Institute

- The Australian and New Zealand Institute of Insurance and Finance

- The Chartered Insurance Institute

- The General Insurance Institute of Japan (GIIJ)

- The Institute of Finance

- The Institutes

- The Insurance Institute of Canada

- The Malaysian Insurance Institute

- Turkish Insurance Institute (TSEV)

chartered insurance institute (cii)

Certificate

Certificate in Insurance

Certificate in Mortgage Advice

Certificate in Equity Release

Certificate in Advanced Mortgage Advice

Certificate in Financial Services

Certificate in Insurance and Financial Services (non-UK)

diploma

Dip CII

Requirement:Member holding the Diploma in Insurance

Dip CII-Claims

Requirement:Member holding the Diploma in Insurance, including a specified claims exam unit, and is a member of the Society of Claims Professionals.

advance diploma

ACII

Requirement: Member holding the Advanced Diploma in Insurance

fellow

FCII

Requirement: Member holding the CII Fellowship

chartered

Chartered Insurer

Chartered Insurance Practitioner

Chartered Insurance Broker

Chartered Insurance Risk Manager

Chartered Insurance Underwriting Agent

Requirement: Title available to a member holding the Advanced Diploma or Fellowship with at least five years’ sector experience (not necessarily post qualification)

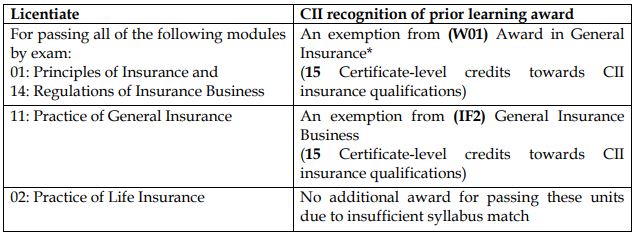

Arrangement scheme between "insurance Institute of India(III)"

and

"Chartered insurance institute(CII)"

For more information on above courses,check website of "CII"

give step to your career path

Your Career's Final Destination in Insurance

Sharpen your Insurance skills

Where Insurance Emerge

Learn Insurance coverage in Global perspective

Community - Building Approaches

Global Insurance Perspective

Insurance Education Globally have Global perspective in Risk Evaluation and Mitigation of the same.

Global Education for all

What do you want to learn Globally?

Global Centres in all major cities

Global Accredited Diploma and Certificates

Flexible Learning Approach for all

Meet and Greet with Like minded Colleagues

Exam Centres in all Major Cities

Save Time and Money on Education

Designation awarded by these Institutes are really great,and well accredited across Industry

Pratyush Sharma UnderwriterGlobal Insurance Education ensure that Insurance aspirants should become subject experts of their field.

Shikha Sharma Claims HeadThe Online method is very compatible to anyone, so that one can earn these credentials without disturb its Worklife.

Aashtha N. Broker